Time for Reflection in the Markets?

Earlier this month, I had the pleasure of taking a rafting trip with my daughter who is now well established in her first job. She is learning that time off is limited and best used to rest and rejuvenate. Our adventure on the Green River through Utah’s Desolation Canyon did just that. The Green starts its journey in Wyoming. By the time it reaches the Sand Wash launch site, its flow is slow with only the occasional rapid to liven the moment and charge your physical senses. Arguably, there is nothing better than spending time with your adult child, but having absolutely no mobile service comes in a close second. There was plenty of time to reconnect with my daughter, get to know the other rafters – from NC, CA & OR – and reflect while watching stars against an ink black sky.

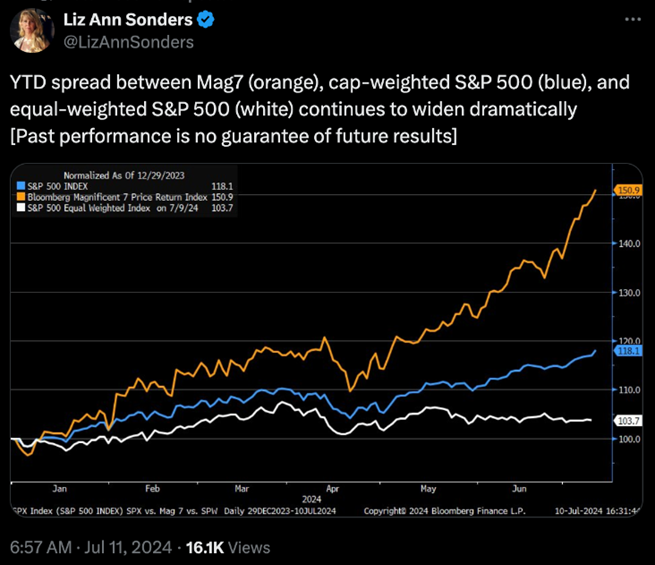

When folks learn what you do, questions always come up about the equity markets, planning tips and topics. This means the market indices we use to track performance always garner some of my attention while away. Because quarterly reports were being prepared during my absence, these became front and center on my return. In particular, the S&P 500 and its gains in 2024. As investment managers, we are keenly aware of its movement, paying special attention to which companies may or may not be having outsized influence. This year has been particularly interesting with a limited number of companies accounting for the lion’s share of the positive performance.

As illustrated by the above graph from Liz Ann Sonders, Director and Chief Investment Strategist at Charles Schwab, at the close of the 2nd quarter, Microsoft, Apple, Nvidia, Google, Amazon, Tesla and Meta (Facebook), with additional lift from the broader technology, communications and utility (power to fuel our electronics) sectors, have fueled S&P quarter and YTD returns. Our portfolios have exposure to these growing companies and the aforementioned sectors, but our diversified, more equal weighted approach, means we hold many investments in the other sectors making up the S&P 500 and also the world. In different market and economic conditions, this diversification has historically smoothed volatility while providing slow, but steady positive returns. As important as that may be, in 2024, it has meant lagging results against the S&P 500 benchmark.

Now back to the part about reflection. I think it’s important to periodically look inward with history as a guide. To think about the paths we chose, and those we didn’t. Can we learn through reflection and alter a path or action that might improve or lead to different outcomes without deviating from core values? In the case of the investments we hold, we learned and found validation that many of our growth-oriented investments kept pace with and sometimes exceeded S&P 500 returns. We also learned that investments intended to balance both growth and value didn’t always meet our expectations. One of these was recently sold and others are being reviewed more critically in an effort to improve. However, it is important to note these same 7 companies served up negative returns of -40% in 2022.[1] During that same time period, the broader S&P 500 was down just over 18%. This 2022 performance illustrated the importance of relying on a more diversified, equally weighted index and the importance of multiple lenses when deciding the correct allocation and mix of investments.

If you would like to discuss any of this further, please let us know. We welcome your questions and the opportunity to address them. In the meantime, we will strive to manage your investments in a prudent diversified manner with the foundational goals of managing risk and achieving steady, long-term positive returns.

[1] Bloomberg. 12/31/21 – 12/31/22