Navigating Toward Success in 2025

Writing is not one of my strengths. I have always preferred physical – more than moving my hand and working my brain – activities. However, I have learned over the years that putting thoughts to paper is made somewhat easier when I keep it simple and use physical reminders in ways that help bring my message to life. That is why my past few newsletters have been linked to recent river rafting trips.

Joys of the River

These trips are populated with people from different parts of the country and wide-ranging perspectives. My fellow rafters are like the multitude of investments that can be used in investment portfolios. Despite differences, they often weave together and express themselves in ways that benefit the group. The river, with its twists, turns, eddies, rapids, placid pools and camp sites remind me of the markets. It continually changes, always offering the unexpected. It requires planning and discipline to navigate safely.

Navigating the river – the markets – in 2024 had its ups and downs but was generally what most of us would consider a success. The US economy was steady and resilient. Employment was strong and companies profitable. The Federal Reserve did a solid job interpreting data and adjusting interest rates which seemed to effectively balance reducing inflation while maintaining economic growth. In short, the river provided manageable challenges and most of us benefitted.

Perils of the River

But the river is fierce and can punish complacency. Rafters become overconfident with their untested skills in slow, calm waters. Less experienced guides, caught up in the success and euphoria of their wards, might become more lenient enforcing discipline in the raft. The beauty and splendor of the surroundings might compel some to lose focus on the task at hand, leading to a close call with a boulder or worse, injury from being thrown out of the raft.

For us looking ahead, don’t just focus on past stability but also consider other extremes. Borrowing liberally from David Kelly, consider the following[1].

- Wealth and debt in the economy

- High valuations

- Concentration in markets

- Financial distortion caused by passive investing and capital gain tax avoidance

- Unbalanced personal portfolios more vulnerable to shocks

There is also substantial noise around tariffs, deportation of unauthorized immigrants and lowering taxes. I liken these to boulders (seen and unseen), eddies and rapids. On a river, individually or together, these can lead to a bumpy, hang on tight kind of ride. Speaking economically, if any or all gain traction, they could increase inflation and negatively impact the markets.

Success on the River

As already mentioned, success on the river – and the markets – requires planning and discipline. It is impossible to predict when the extremes will happen and their impact. But there are steps we can take to mitigate the worst and come out of the rapids relatively unscathed and still in the raft.

High valuations and concentration in the U.S. markets are pushing extremes. The S&P 500 forward price to earnings (P/E) valuation stands at almost 21.4x vs. the 30 yr. average of 16.8x. Within the S&P 500 index, the top 10 stocks account for almost 39% of the total and carry an even higher P/E multiple of 29.6x. The U.S. now accounts for a record 67% of global market capitalization and non-US stocks trade at a 38% P/E discount to U.S. stocks.

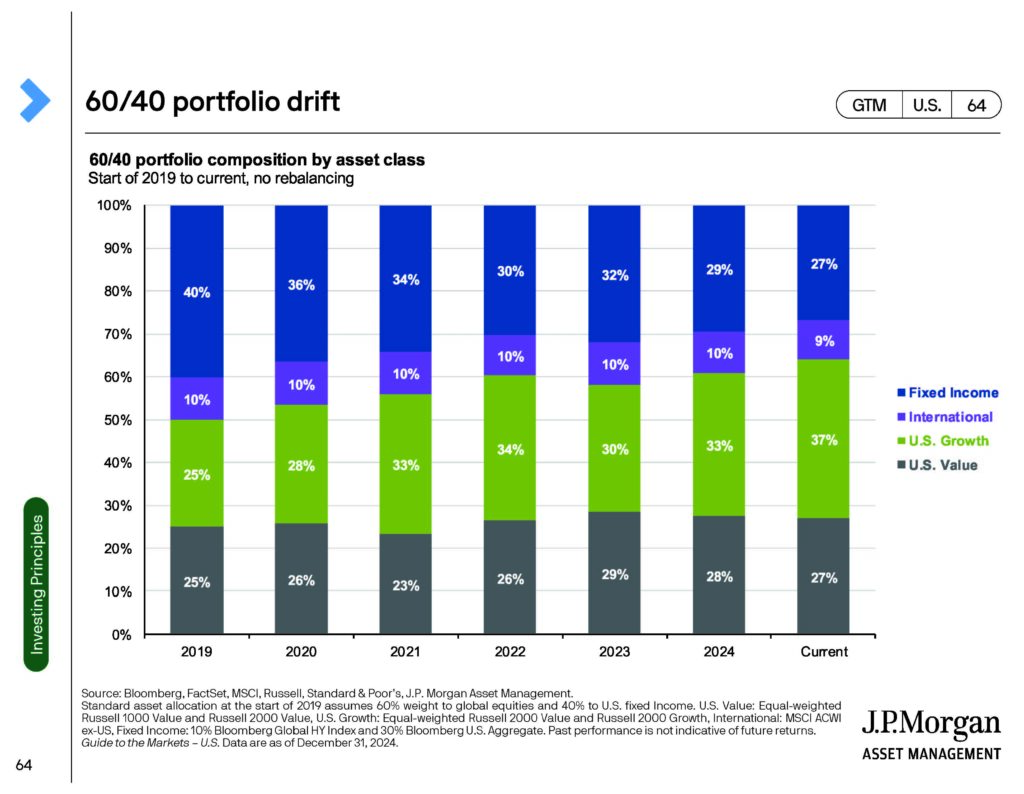

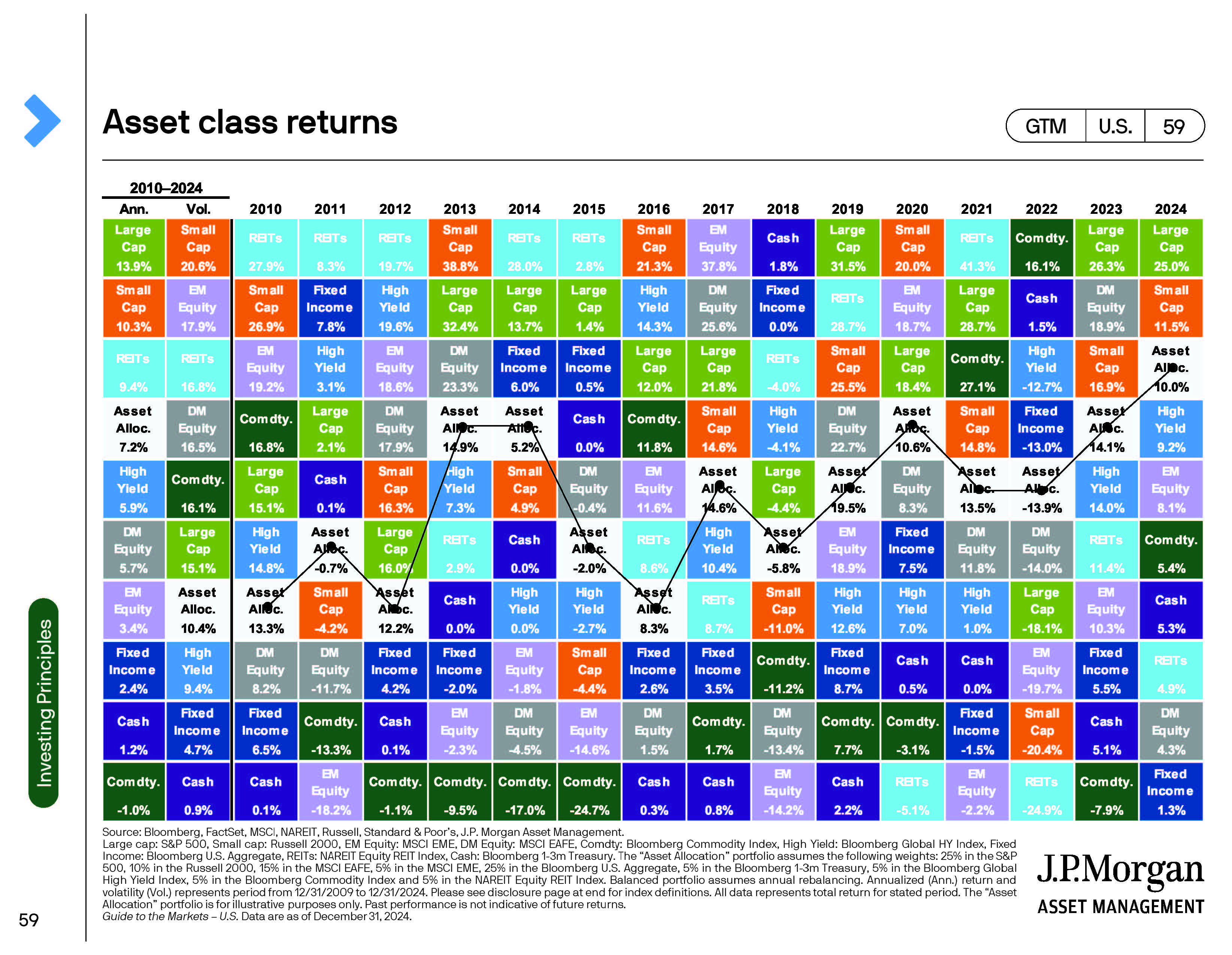

For portfolios that rely heavily on passive index funds or that have not been rebalanced in several years to avoid capital gain taxes, the impact of economic shocks can be more substantial. What David Kelly of J.P. Morgan describes as 60/40 portfolio drift, is illustrated on page 64 of J.P. Morgan’s 1Q2025 Guide to the Markets. ( (A link to the full guide is at the end of this post). This is why we rely on and prefer more equally weighted, actively managed investments combined with regular rebalancing. This approach and its historical returns are illustrated on page 59 of the guide. Asset class returns vary year-over-year so it’s important to hold a diversified basket and to rebalance them regularly. I would suggest the asset allocation strategy offers the smoothest, less volatile path through the river.

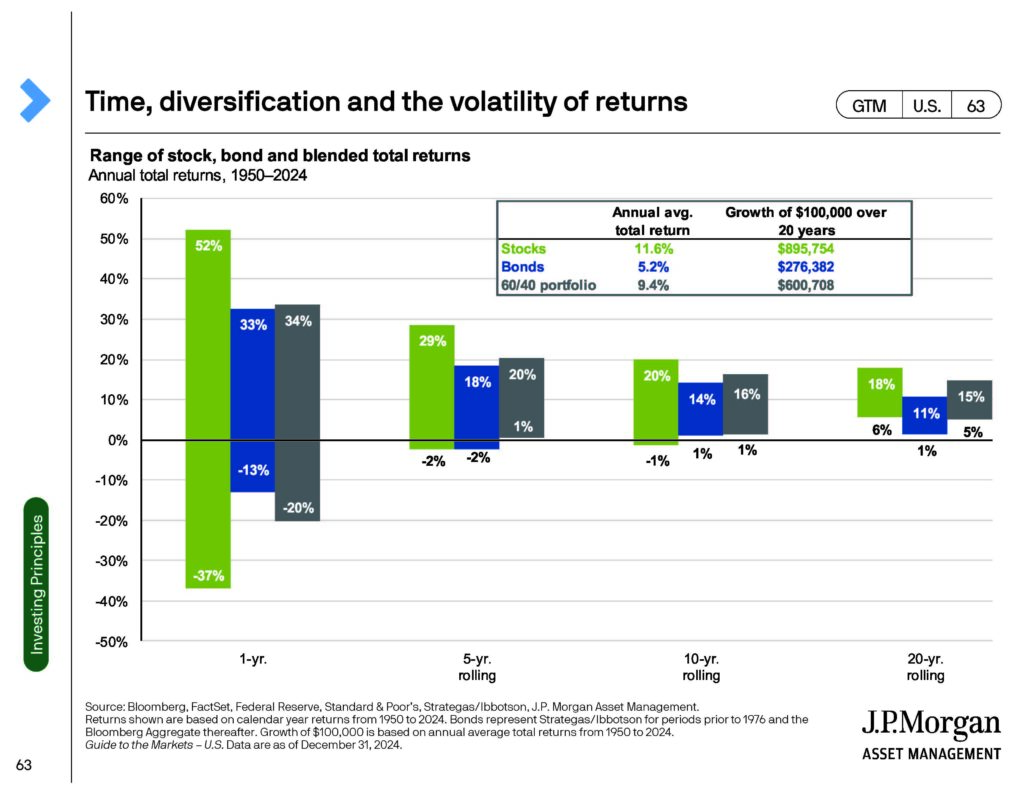

Success on the river requires both short- and long-term vision. Concentration through rapids, avoiding eddies and sticking to the trail at sightseeing stops along the way, can lead to a satisfying conclusion. As illustrated on page 63 of the guide, the markets will sometimes give us extreme ups and downs. With discipline (see 60/40 portfolio return) and time, even short-term volatility can still result in long-term success.

In Conclusion

In June of this year, I plan to take a rafting trip on the Rogue River in southern Oregon with my daughter. It will be our third river trip, and I hope there will be many more. Last year, we explored the Green River in eastern Utah. The Green was, for the most part, slow and steady. I’ve been told the Rogue is fast and full of difficult rapids. Seems last year’s trip mirrored the 2024 markets. I wonder if 2025 will result in the same.

| J.P.Morgan’s 1Q2025 Guide to the Markets https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/ |